You are here:Chùa Bình Long – Phan Thiết > chart

Is Coinbase Cheaper Than Binance?

Chùa Bình Long – Phan Thiết2024-09-21 22:56:30【chart】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrency exchanges, Coinbase and Binance are two of the most popular platforms airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrency exchanges, Coinbase and Binance are two of the most popular platforms

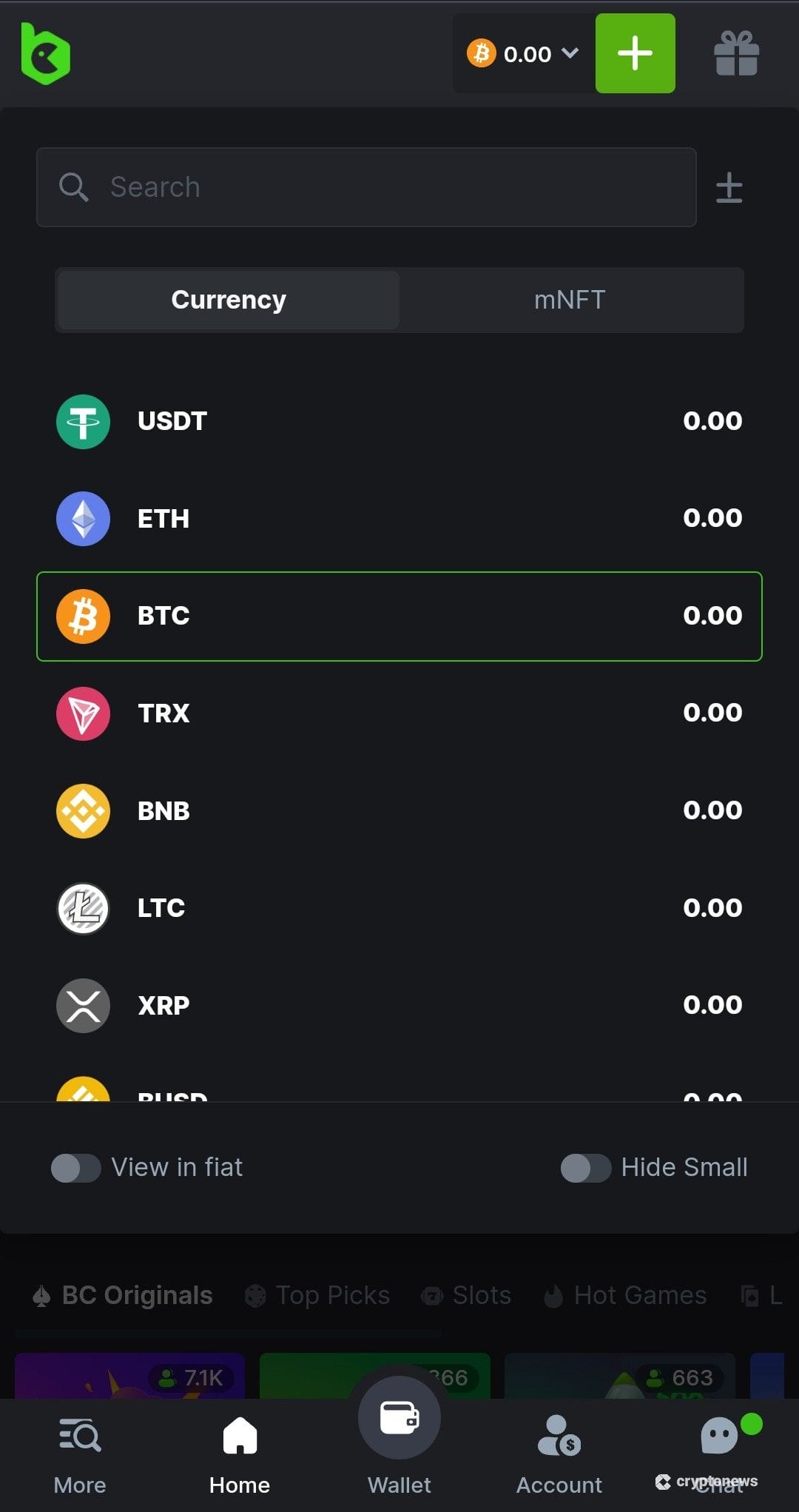

In the world of cryptocurrency exchanges, Coinbase and Binance are two of the most popular platforms. Both offer a wide range of services, including trading, staking, and wallet solutions. However, many users are often curious about the cost differences between the two platforms. Is Coinbase cheaper than Binance? Let's dive into the details to find out.

Firstly, it's essential to note that the cost of using Coinbase and Binance can vary depending on several factors, such as the type of transaction, the amount of cryptocurrency being traded, and the fees associated with each platform. In this article, we will compare the fees and pricing structures of both Coinbase and Binance to determine which one is cheaper.

One of the primary factors that contribute to the cost difference between Coinbase and Binance is the fee structure. Coinbase charges a flat fee for each trade, while Binance uses a tiered fee structure based on the trading volume.

Coinbase charges a standard fee of 0.50% for each trade, regardless of the amount being traded. This means that if you were to trade $1,000 worth of cryptocurrency, you would be charged $5 as a fee. Additionally, Coinbase also charges a network fee for deposits and withdrawals, which can vary depending on the cryptocurrency being used.

On the other hand, Binance has a more complex fee structure. The platform charges a flat fee of 0.1% for each trade, but this fee can be reduced by trading on higher tiers. The tier system is based on the trading volume over the past 30 days, with higher trading volumes leading to lower fees. For example, if you trade $10,000 worth of cryptocurrency, you would be charged a fee of $10. However, if you trade $100,000 worth of cryptocurrency, the fee would be reduced to $5.

Another factor to consider is the deposit and withdrawal fees. Coinbase charges a network fee for deposits and withdrawals, which can vary depending on the cryptocurrency being used. For example, depositing Bitcoin into your Coinbase account may incur a fee of $0.0044 per BTC, while withdrawing Bitcoin may cost $1.49 per BTC.

In contrast, Binance does not charge a network fee for deposits and withdrawals. However, users may need to pay a small fee to the blockchain network itself, depending on the cryptocurrency being used. For example, depositing Ethereum into your Binance account may incur a fee of $0.015 ETH, while withdrawing Ethereum may cost $0.015 ETH.

When comparing the overall cost of using Coinbase and Binance, it's essential to consider the trading volume and the frequency of transactions. If you are a high-volume trader, Binance's tiered fee structure may be more cost-effective, as the fees decrease as your trading volume increases. However, if you are a low-volume trader or a beginner, Coinbase's flat fee structure may be more straightforward and easier to understand.

In conclusion, the answer to the question "Is Coinbase cheaper than Binance?" is not straightforward. Both platforms have their own unique fee structures, and the cost-effectiveness of each platform depends on the user's trading habits and volume. For high-volume traders, Binance's tiered fee structure may be more cost-effective, while Coinbase's flat fee structure may be more suitable for low-volume traders or beginners. Ultimately, it's essential to do your research and consider your own trading needs before deciding which platform is the cheaper option for you.

This article address:https://www.binhlongphanthiet.com/btc/16e61399370.html

Like!(43226)

Related Posts

- How is Mining Bitcoin Reported?

- How to Move Coins from Binance to Wallet: A Step-by-Step Guide

- Binance Trade History Export: A Comprehensive Guide to Managing Your Trading Data

- Which Bitcoin Wallet is Best in Venezuela?

- Step Coin Binance: A Comprehensive Guide to Understanding and Utilizing This Innovative Cryptocurrency Platform

- Iran Mosque Bitcoin Mining: A Controversial Trend

- Best Way for Mining Bitcoins: A Comprehensive Guide

- Bitcoin Mining Rig with GPU: A Comprehensive Guide

- Antminer Bitcoin Mining Rigs: The Ultimate Tool for Cryptocurrency Mining

- Bitcoin Mining Rig with GPU: A Comprehensive Guide

Popular

Recent

Gigabyte Bitcoin Mining Motherboard: The Ultimate Choice for Aspiring Cryptocurrency Miners

How Many Bitcoin Cash Are Left: The Current Status and Future Outlook

Bitcoin Mining Nuclear: A Controversial and Energy-Intensive Process

Why Binance Coin is Growing

Why Is the Price of Bitcoin Different Between Exchanges?

The Stock Symbol of Bitcoin Cash: A Comprehensive Guide

Bitcoin Wallet Online Private Key: Understanding Its Importance and Security Measures

Itbit Bitcoin Cash: A Comprehensive Guide to the Popular Cryptocurrency Platform

links

- Cryptocurrency Mining Bitcoin: The Digital Gold Rush of the 21st Century

- Making an Anonymous Bitcoin Wallet: A Comprehensive Guide

- Is Dogecoin Listed on Binance? A Comprehensive Guide

- Crypto Wodl Binance Answer Today: Unveiling the Future of Digital Currency

- How to Send Bitcoin from Bitcoin.com Wallet: A Step-by-Step Guide

- Can Bitcoin Continue to Rise?

- How Much BNB to Buy on Binance: A Comprehensive Guide

- How to Withdraw USDT from Binance: A Step-by-Step Guide

- Binance BNB Trading Fees: Understanding the Costs and Benefits

- Title: A Comprehensive Guide to Setting Up Bitcoin Mining on Ubuntu